The challenge of mining in Greenland

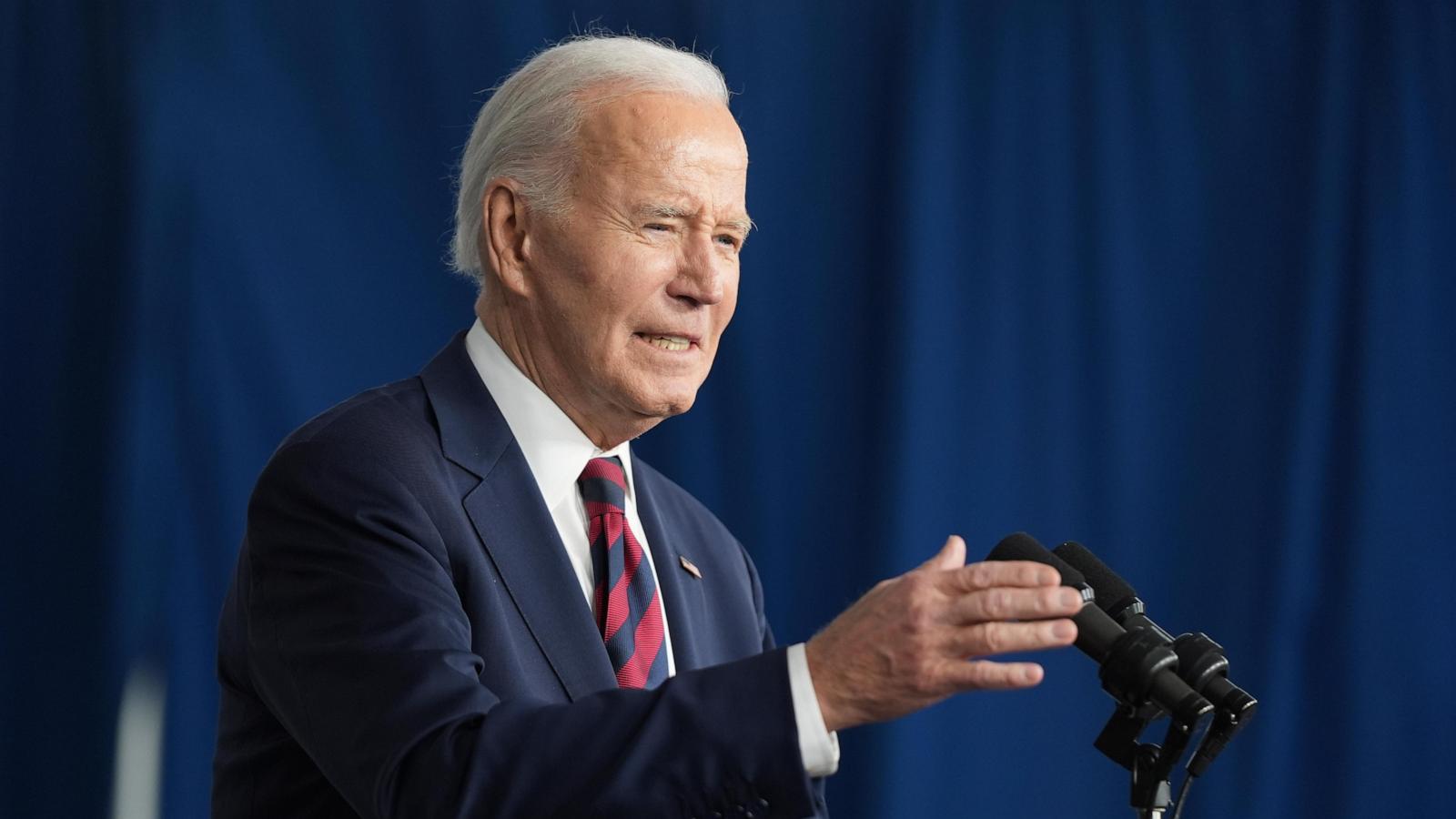

Greenland has likely received more international news attention in the past 90 days than in the previous 90 years. President Trump has been explicit: he wants America to control Greenland, predicting untold riches for the local population. On March 4, the president directly addressed the people of Greenland during a joint session of Congress.

“We will make you rich, and together, we will take Greenland to heights like you have never thought possible before,” Mr. Trump declared.

Although the 57.000 people living in Greenland would no doubt welcome more American investment, their appetite for America taking control of the island, which is currently part of the Kingdom of Denmark, seems limited. A poll from January 2025 shows that only 6% of the predominantly Indigenous Inuit population wants to become American—and this poll was conducted before Mr. Trump refused to rule out using force to acquire Greenland “one way or the other.” This statement did not sit well in the capital of Nuuk.

Mr. Trump’s claim that the U.S. needs Greenland “for national security and even international security” is being tested.

Danish political scientist Ole Wæver tells 60 Minutes that it doesn’t add up.

“You can only get to that conclusion by kind of messing up everything,” he said. “Throwing in five, six different military security dynamics and then treating them as one mysterious whole. If you break them up and take them one by one, then you will, for each of them, say, ‘That would not change by possessing Greenland.’ You either have access already, or it’s not a real issue, or someone else is doing it. There are none of those questions where it’s really about possessing Greenland.”

The other reason for the Trump administration’s proposing the acquisition of Greenland is access to the territory’s untapped natural resources.

Beneath the snow and ice-covered surface of this vast territory lie valuable resources such as gold, copper, graphite, zinc, and rare earth minerals necessary to power the global economy. Rare earths are particularly needed for producing batteries for electric cars, mobile phones, solar and wind-powered turbines.

The argument is that by acquiring Greenland, the U.S. will access a treasure trove of minerals essential for competing with China in the high-stakes, high-tech race for global dominance.

It is not only the Trump administration that sees Greenland as an attractive potential acquisition. The British magazine The Economist, although warning Mr. Trump about forcing his will on the territory, writes that persuading the Greenlanders to become Americans “could be the deal of the century.” The Economist points to a U.S. Geological Survey report showing the presence of 43 of 50 minerals deemed critical by the US, and a 2008 USGS report that claims that wells on the coast could yield 52 billion barrels of oil.

However, Greenlandic geologist Minik Rosing criticizes the interpretation of the report. He says the USGS did not assess Greenland as having oil and gas reserves.

“They said that there is a potential for oil, but there has been oil and gas exploration in Greenland for 50 years, and they haven’t found any,” Rosing said.

60 Minutes

Rosing, a native Greenlander and professor at the University of Copenhagen, is credited with making life on Earth no less than 300 million years older by discovering a carbon signature in Greenlandic rock formations. He has spent years studying the territory’s terrain. He argues that the assumptions about getting rich quickly from untapped resources in Greenland are akin to planning to get wealthy by playing the lottery. The widespread lack of detailed knowledge about geology, mining, and minerals has resulted in, he says, an almost “mythological misunderstanding” of what rare earth elements truly are.

“In geology, we say what characterizes rare earths is that they are neither rare nor earth. They are a group of metals that are commonly occurring in many rock types, and there are large known deposits of them throughout the world,” Rosing explained to 60 Minutes.

According to Rosing, nothing points to a special concentration of minerals and rare earths in Greenland, and there are many places in the world where minerals are easier and cheaper to obtain, such as the USA.

In the U.S. Geological Survey’s overview of known rare earth reserves from 2024, Greenland sits eighth in the table, ranked just behind the US but far behind countries such as China, Vietnam, and Brazil.

One mining geologist, who 60 Minutes spoke with on background, says the focus should be more on the quality of the minerals than the quantity. Besides, he says, the U.S. already has many untapped rare earths and minerals in states like California and Alaska.

According to Rosing, the reason these resources remain untapped is that mining is often unprofitable. Furthermore, the U.S. lacks the technologies required to refine the raw materials. Almost all the minerals extracted from U.S. soil are sent to China for processing. Notably, the largest U.S. rare earth minerals mine, Mountain Pass in California, is co-owned by the Chinese government-owned firm Shenghe, which holds around 8% of its shares.

The issue lies not only in accessing the minerals but also in refining and sourcing them—transforming them into the magnets and batteries necessary for cars, computers, and more. Rosing told 60 Minutes that China primarily dominates this market, and acquiring Greenland will not alter that.

“You don’t know if you can sell the product, and you also lack the capacity in either Europe or the US for processing metals and refining them into final products. Furthermore, even the products made from it are often manufactured in China anyway,” explained Rosing.

According to several scientists interviewed by 60 Minutes, the real issue for the West in reducing its reliance on China is not to acquire more territory but to develop facilities for processing raw materials and foster a competitive market. That effort would likely require substantial economic subsidies and political will.

“We can decide if we will pay a premium price to have it produced in our own realm, so to speak. I think that’s a main enabler of mining anywhere not specific to Greenland,” Rosing said. “How many new mines have been opened in the U.S. or in Europe in the past ten years or 20 years? Very few.”

The Greenlandic geologist is puzzled by why the U.S. believes it needs to acquire Greenland at all. The Greenlandic government has actively sought American investment for over 30 years with limited success. When asked if he thinks the voices in Mr. Trump’s inner circle, which boast of a wealth of mineral riches in Greenland waiting to be explored, are similar to fool’s gold, Rosing replies, “To some extent, yes. It is a mirage because it has been described as this very easy access to very rapid wealth. And that is not the case.”

60 Minutes

There are only two active mines in Greenland. 60 Minutes visited the Amaroq Gold Mine in the territory’s southwest, where the Icelandic CEO, Eldur Olafsson, has taken over a closed mine.

With prudent planning and gold prices at all-time highs, Olafsson believes that serious money can be made there. He says that investors have contributed around $250 million to the project, which has so far produced only one gold bar. According to Olafsson, more is on its way, and he estimates that his gold mine alone can yield gold worth $150 million annually. However, it is not a short-term game.

“Our investors need to be long-term investors. They need to be willing to take the risk. They need to understand the opportunity that the mining and infrastructure sector has been underinvested, especially in a country like Greenland, for decades,” Olafsson said. “They look at long-term play. And therefore, they need to have the belief, the geological belief, that this is all here. And they need to believe in us that we can actually execute, and that takes time.”

One geologist familiar with the area that 60 Minutes visited was skeptical about the prospects, while Rosing has maintained a more optimistic view of gold mining in Greenland.

“I think it’s reasonable, and I think that is a very special case,” he said. “And it somehow illustrates what the problem with mining is. A gold mine mines money, there’s no problem selling gold.”

The CEO of Amaroq Minerals, the biggest holder of exploration licenses in Greenland, believes their gold mine can be used as a model for mining minerals and rare earths. However, Rosing is more skeptical.

“For all the other metals, you need to have a market. And if that market is completely controlled by, let’s say, China, as is the case for most of the critical markets, it’s not an open market, so you don’t know what the price is,” Rosing said. “The problem with rare earth metals is that you cannot just have the ore and extract it and then think that that will give you the metals the next day because the capacity to process the ore, refine the metals, separate them and make them into useful components in the electronics industry is a very, very long one.”

If Rosing is correct, it raises questions about the value of the strategy to acquire Greenland and the mineral deal in Ukraine that the Trump administration is seeking to broker. Nevertheless, the geologist is optimistic about a sustainable mining future in Greenland, emphasizing that Greenlanders generally support mining.

“Greenland is a wonderful place. It is a treasure trove of many things. But it is not a place where money is just sitting in the ground waiting to be picked up. There is no gold there in the streets,” Rosing said. “I think that Greenland is a treasure to the world. I mean, it is a fantastic place. It has the only ice sheet in the Northern Hemisphere. It has the narwhals. It has all kinds of wonderful things. And also, it has mineral resources. It is something that, with the right policies and the right planning, can help us be independent of China for the critical minerals. But it needs will, and it needs time.”

The video above was produced by Will Croxton. It was edited by Sarah Shafer.

Video of Minik Rosing courtesy of Jakob Gottschau.