Tax tips for those who still haven’t filed

If you’re still scrambling to get your taxes filed before the April 15 deadline, an extension can take the pressure off.

Normally, the IRS recommends that people file their income tax return as early as possible. But that’s not always feasible, whether because of personal circumstances or a complicated tax situation. For those in a bind, a tax extension gives people an additional six months to file their federal return. The quick and free process gives Americans plenty of extra time to assemble their forms, work through complex tax situations and submit everything to the government without penalty.

As of April 4, roughly 100 million people had already filed their taxes, according to the IRS. The tax agency said in January that it is expecting more than 140 million individual tax returns to be filed before the April 15 deadline, meaning there are likely millions of outstanding 1040s yet to be filed.

Taxes are typically a major source of stress for Americans. In an April TaxAct survey, a quarter of respondents said one of their top concerns was filing their taxes incorrectly. Those polled also expressed uncertainty around what to expect when filing, with one-quarter of respondents saying they worried about having to pay more taxes than they’d expected.

If you’re planning to file a tax extension this year, here are some things to keep in mind.

What is the 2025 filing deadline?

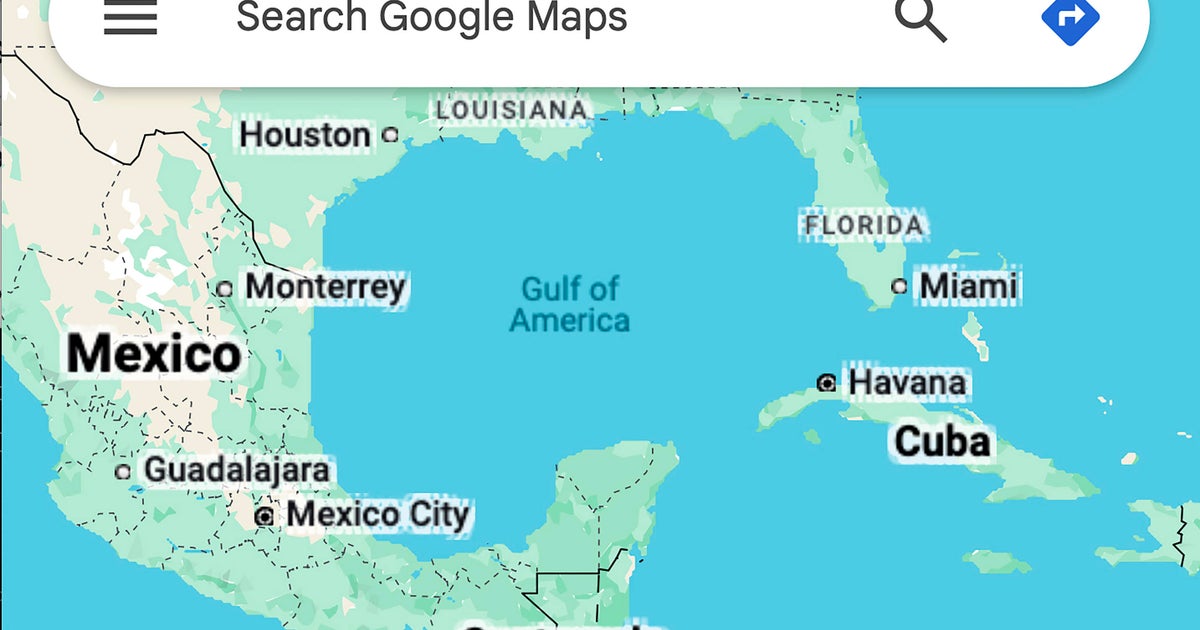

The deadline to file your taxes this year is Tuesday, April 15, by 11:59 p.m. in your local time zone. However, there are exceptions.

This year, the IRS extended the deadline for 13 states due to natural disasters in those areas. All taxpayers in Alabama, Florida, Georgia, North Carolina, South Carolina, and certain locations in Alaska, New Mexico, and Virginia have until May 1 to file their returns. Taxpayers in California’s Los Angeles County have until October 15. And people in Arkansas, Kentucky and Tennessee, as well as in certain counties in West Virginia, have until November 3 to file.

U.S. citizens and resident aliens who live outside of the U.S. are also granted an automatic extension of two months.

How do I file a tax extension online?

The IRS offers a few different ways for people to extend their tax deadline to October 15. The online payment system, which allows you to pay the IRS directly from your bank account, debit card, credit card or digital wallet, has a box you can check if you need to file for an extension.

Taxpayers can also electronically request an automatic tax-filing extension while using IRS File Free, which guides taxpayers through their federal income returns using tax preparation software.

Another option is to file a Form 4868, which is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. It asks for basic information including your name, address and Social Security number. You can file a Form 4868 electronically by using IRS e-file or mailing the form to the IRS.

If I get an extension, does that mean I have more time to pay the IRS?

Even if you get an extension, you are still required to pay the IRS by the regular deadline if you owe money. As the IRS says, “an extension gives extra time to file, but it does not give taxpayers extra time to pay if they owe.” If taxpayers want to avoid financial penalties, it’s best to estimate the amount you owe and pay it by the regular deadline, which is 11:59 p.m, Tuesday, April 15.

Is there a penalty for filing taxes late?

Yes. The IRS charges individuals and businesses a fine if they fail to file their return by the deadline or by their extension date. The “failure to file penalty” is 5% of the tax due for each month the return is late and is capped at 25%.

What happens if I file but don’t pay?

The IRS levies a fine based on the amount of taxes you didn’t pay. The “failure to pay penalty” is 0.5% of the unpaid taxes for each month, with a cap of 25% of the unpaid taxes. You would be subject to the penalty if you file your taxes on time but don’t pay by the April 15 deadline.

Tax filers can avoid the “failure to file” and “failure to pay” charges if they can prove that they missed the payment due to a reasonable cause. “Reasonable cause is determined on a case by case basis considering all the facts and circumstances of your situation,” the IRS says.

What if I can’t afford to pay the IRS?

The IRS offers both a short-term and long-term payment plan for taxpayers struggling to pay what they owe to the IRS. Those interested in applying can do so on the IRS website.